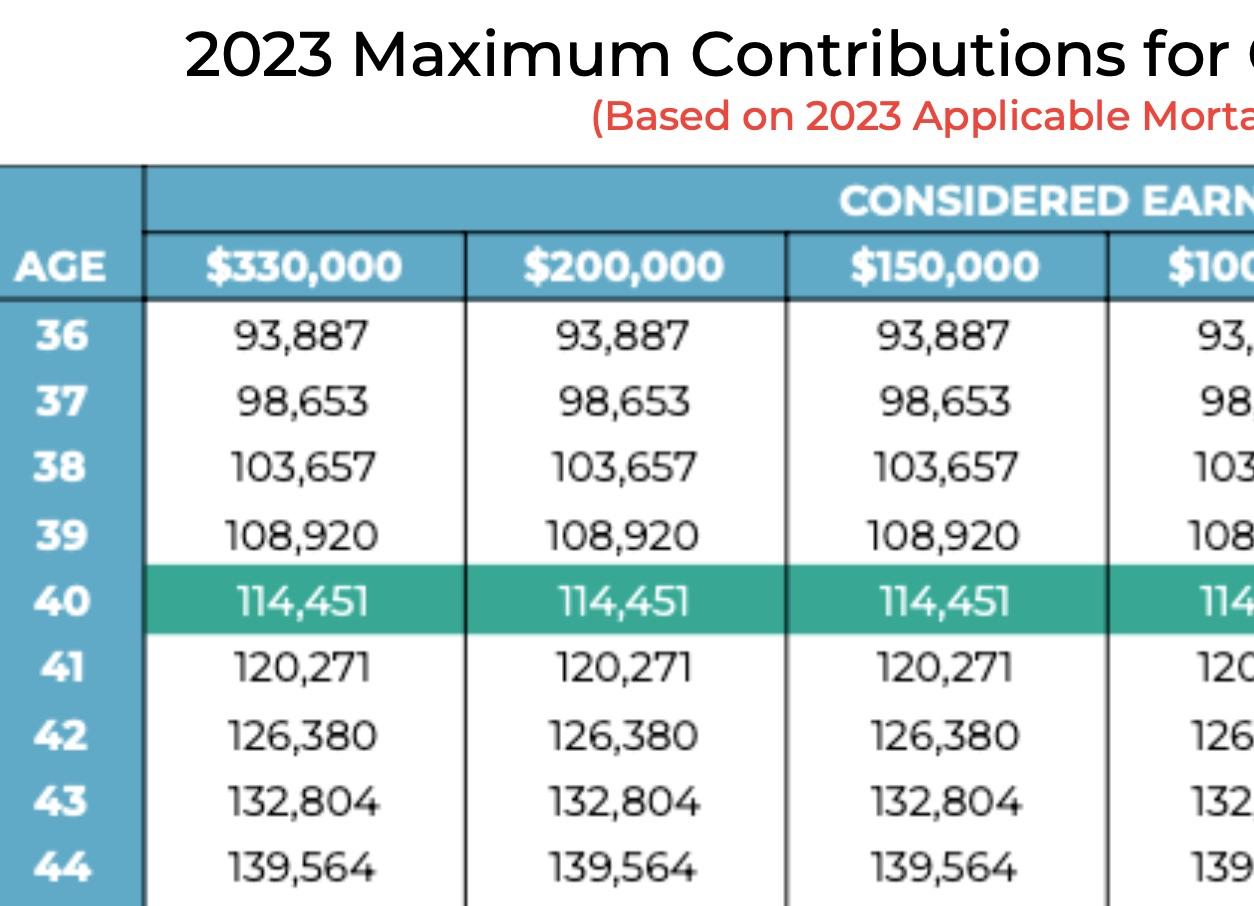

2023 Cash Balance Plan Maximum Contributions Table

Looking for ways to minimize your company’s tax liabilities? Watkins Ross can help you achieve this goal through the implementation of a cash balance plan.

One of the significant advantages of a cash balance plan is the ability to contribute more to principals than what is statutorily allowed in a profit-sharing plan. By contributing more money to a cash balance plan, individuals can potentially see larger returns in their retirement funds. Additionally, the ability to defer taxes on the contributed income until a later date when the individual’s tax bracket may be lower can be advantageous for long-term financial planning.

To help businesses understand the benefits of a cash balance plan, Watkins Ross has created a chart that reflects the contributions based on age and compensation. This chart is just the starting point of the discussion to determine if the plan is suitable for your business as there are many other factors to consider.

Download Our 2023 Cash Balance Plan Maximum Contributions Table

Watkins Ross is dedicated to helping businesses maximize their retirement savings and minimize their tax liabilities. Interested parties are encouraged to contact us to learn more about how we can assist in achieving their financial goals.