You are tasked with determining an appropriate discount rate for determining the Net OPEB liability under the Governmental Accounting Standards Board Statement (GASB) Nos. 74/75 for a closed, underfunded retiree healthcare plan whose plan sponsor plans to make minimal if any future contributions to the existing OPEB trust. The plan sponsor will, however, continue to pay retiree healthcare payments from general operating funds. What is the appropriate discount rate? Is it

- A rate that reflects the long term expected rate of return on the existing OPEB Plan investments

- A tax-exempt, high quality municipal bond rate

- A blend of the two rates in choices ‘A and ‘B’

Based on the limited information provided in this example one would be inclined to choose ‘C. A blend of the two rates’ as that would seem to meet the spirit of the GASB Standard. However, a literal interpretation of the Standard (and supported by GASB’s implementation Guide No. 2017-3) would lead one to conclude ‘A. A rate that reflects the long term expected rate of return on the existing OPEB Plan Investments’ so long as those funds are never used (or at least not to the extent they become depleted) to pay retiree healthcare benefits. While this approach would likely please the entity responsible for carrying an OPEB liability on the balance sheet, this interpretation is one that in my opinion runs contrary to the intent of GASB.

Because, according to the GASB Implementation guide, “the determination of the results of an alternative approach in making the evaluation required are sufficiently reliable for [the purpose of evaluating the sufficiency of future plan fiduciary net position to make projected benefits payments] is subject to professional judgment” I propose the following:

- Project future assets taking into account all appropriate distributions and contributions (per the current recommended approach)

- Discount all payments from general operating funds (PVB) – whether or not the payment is considered a contribution to the trust, reimbursement to the trust of retiree benefit payment or direct payment of retiree healthcare costs or premiums – using the tax-exempt, high quality municipal bond rate

- Choose the single rate such that the sum of all projected benefit payments discounted at this rate equals the sum of the discounted payments from general operating funds (PVFC) plus the market value of assets (MVA) used to pay benefits

My rationale for using the market value of assets as a proxy for the sum of discounted projected benefit payments from these assets is that the market value of assets is implicitly the sum of the future benefit payments discounted at the long term expected rate of return only to the extent those future benefit payments come from plan assets and not general operating funds. And, to the extent that future contributions from general operating funds delay (or prevent) the depletion of plan assets – i.e. fund future benefit payments – under this approach the future benefit payments funded by those contributions will implicitly be discounted at the long term rate of return only while part of the OPEB trust and otherwise discounted at the tax-exempt rate from the time it was contributed from general operating funds.

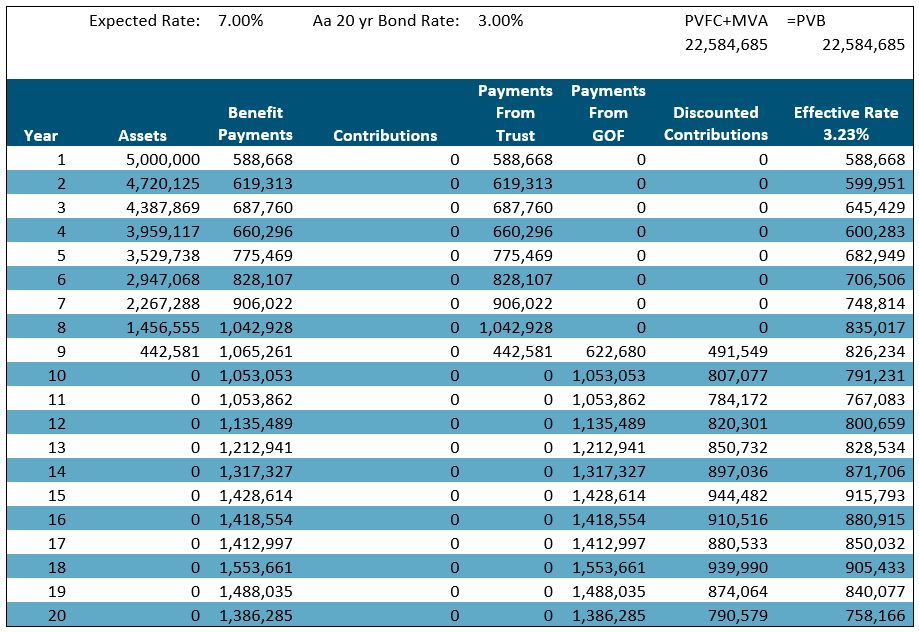

To illustrate, assume $5,000,000 initial plan assets, 7.0% long term rate of return and 3.0% bond rate, with benefit payments and contributions made at beginning of year; projections only shown through year 20

Scenario 1

- No future contributions to the OPEB trust

- future benefits funded on a pay-as-you-go basis

Note: if payments are not taken from the trust in this example (assets not depleted) those assets would not be added to the Present Value of Future Contributions (as only assets used to pay benefit are included) and the average effective rate would be 3.0%

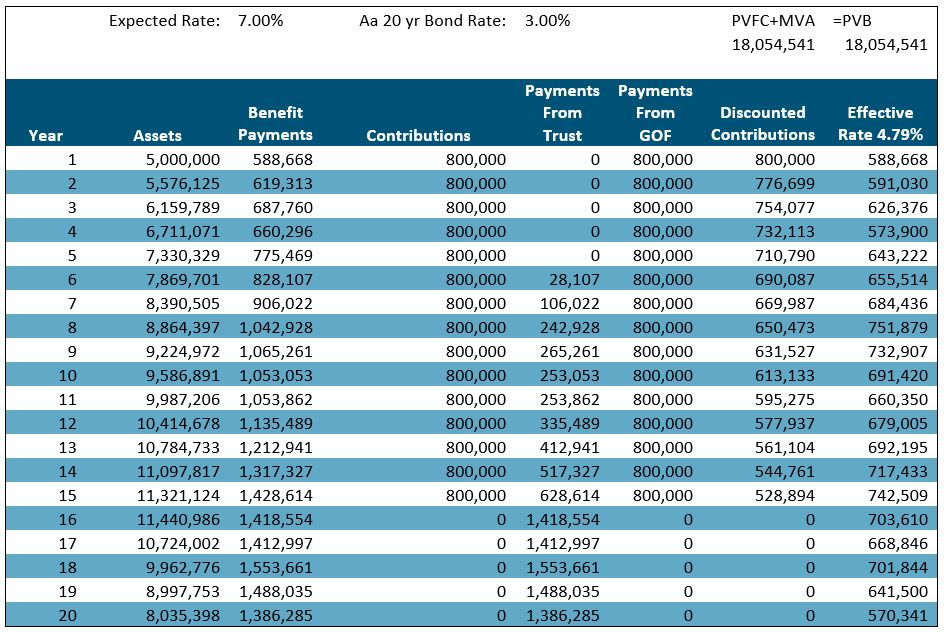

Scenario 2

- Annual contribution to OPEB trust (or payment/reimbursement of benefit payments) of $800,000 per year for 15 years

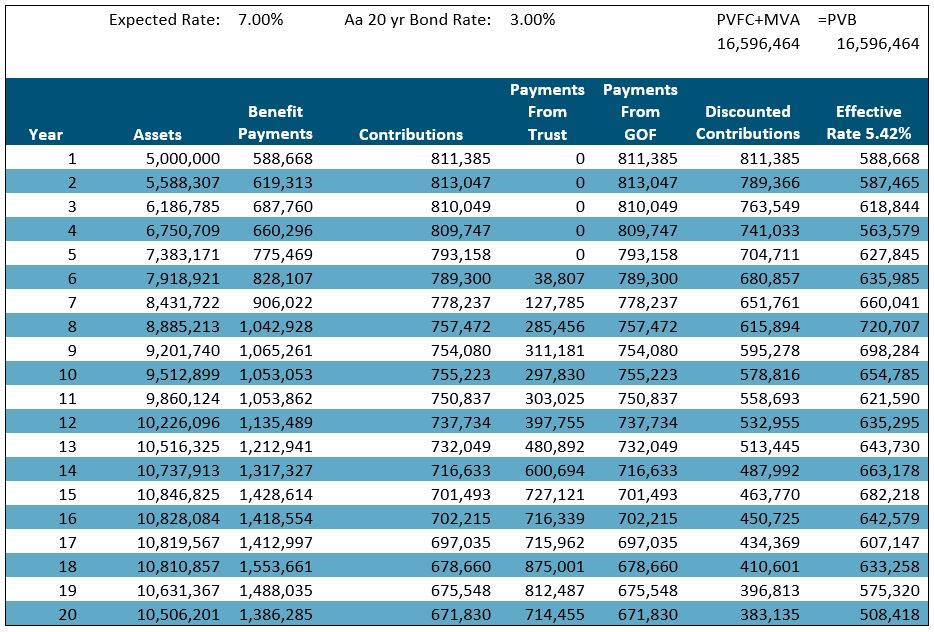

Scenario 3

- Annual contribution necessary to cover the normal cost for current covered lives and level dollar amortization of the unfunded liability of the plan over 20 years assuming 7.0% annual return on plan assets

One will notice that under the third scenario the single discount rate is less than 7.0% despite a funding policy to fully fund the plan. This is due to the need to reflect the financing of future contributions until such time as the plan is sufficient to pay benefits. The only time the long term rate of return will be the single rate used for determining the Net OPEB Liability would be when the plan is fully funded.

This proposed approach reflects GASB’s stated intent that the “projections of the OPEB plan’s fiduciary net position … incorporate all cash flows for contributions from employers…, if any, intended to finance benefits of current active and inactive plan members.”

It is my hope that GASB will reconsider its support of a method that, while consistent with a literal reading of the Standard, runs contrary to the intention that the “information about rates of return on OPEB plan investments will inform financial users about the effects of market conditions on the OPEB plan’s assets over time and provide information for users to assess the relative success of the OPEB Plan’s investments strategy and the relative contribution that investment earnings provide to the OPEB plan’s ability to pay benefits to plan members when they come due.”

This blog was authored by Christian R. Veenstra, President of Watkins Ross.