Controlled group rules exist to prevent business owners from subdividing their company into two separate companies – one employing highly compensated employees (HCEs) with a retirement plan and the other employing non-highly compensated employees (NHCEs) with a lesser plan or no retirement plan at all.

A controlled group is a group of companies that have shared ownership and, by meeting certain criteria, are eligible to combine their employee bases into one 401(k) plan. A simple example is a parent-subsidiary group in which the parent corporation owns 100% of its subsidiary or subsidiaries.

However, there are many more complicated rules that make this analysis less straightforward. There are brother-sister controlled groups, for example. These generally consist of a group of companies that have five or fewer owners who are individuals, trusts, or estates that satisfy an 80% common ownership test and a 50% identical ownership test.

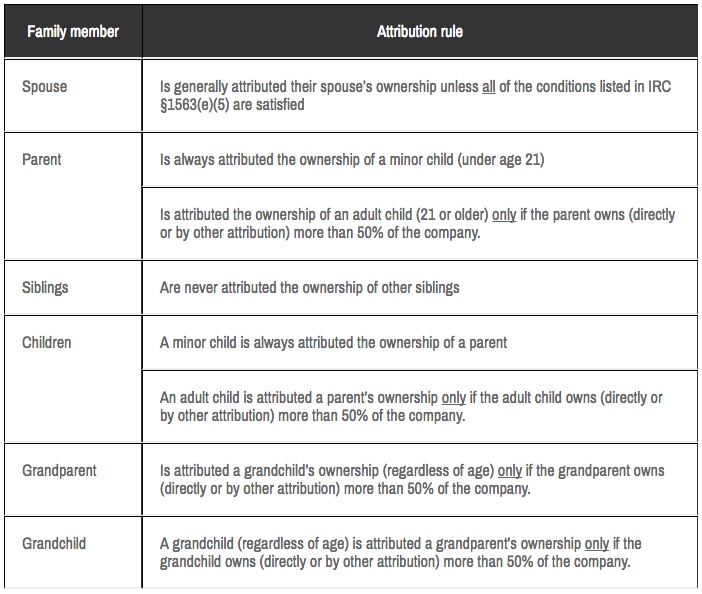

There are also “Attribution” rules. Under these rules, the ownership interest of certain family members is added to the direct ownership of an individual. For example, if a husband and wife each have a 40% ownership stake in a company, each spouse would be considered to own 80% (40% direct + 40% attributed) of the company for controlled group purposes.

Attribution rules are as follows:

Since nondiscrimination and coverage tests for qualified retirement plans must be run on a controlled group basis it is extremely important that those running the annual tests be informed of any common ownership between companies, and any family groupings. If there is any doubt regarding controlled group status, it is recommended that the advice of an attorney be sought. Failed tests must be corrected within the prescribed time frame as failure to do so could result in IRS disqualification of the plan.

Are you wondering how to navigate controlled group rules within your company? Connect with the Watkins Ross Client Management Team to obtain a detailed look at your company’s retirement plan structure. With the help of our experienced actuaries, Watkins Ross can provide the information you need to avoid penalties and disqualification.